Kerwin Stenstrom has watched housing prices in Hawaii rise. A lifelong renter, he never thought he would own a home here. But eight years ago, he decided it was time to make the leap of faith.

“I didn’t want to pay someone else’s mortgage as a renter when I can own a piece of the rock myself,” said Stenstrom, a single dad.

Stenstrom turned to the Hawaii HomeOwnership Center, a nonprofit that helps local families become home owners. The center helped him budget his finances to afford the down payment, closing costs, and monthly mortgage. The center also helped him find loans he qualified for and walked him through the paperwork.

“I’m not fortunate like some to have a parent who can help with the down payment,” he said. “Sometimes it takes a little bit of luck or someone watching over you. But I wouldn’t have been able to do with without the Hawaii HomeOwnership Center.”

Kerwin Stenstrom, a 53-year-old safety and security supervisor at Hawaii Job Corps, with his 12-year-old son Tyler in their Plantation Town Apartments home in Waipahu.

Stenstrom said the center eased a lot of the stress of buying a home. He said owning a home has given him foundation for the future. He doesn’t have to worry about rent hikes or moving at the end of a lease. “There’s peace of mind knowing this is our place and we own it. We can do what we want without having a landlord breathing down your neck,” he said.

For many in Hawaii, buying a home is out of reach. Hawaii has one of the highest home prices in a U.S. In 2017, the average price of a home was $795,000, compared to $205,000 in 1985. Working two jobs and ohana-style living (multi-generational families under one roof) is common to make ends meet, adding to stress to a family’s well-being.

The Hawaii HomeOwnership Center helps people find a path to owning their own home. Members pay a one-time lifetime fee of just $60 and complete eight hours of classes that focus on:

• Creating a budget.

• Reviewing your finances and credit score.

• Searching for loan programs.

• Tips on shopping for a home.

Members work one-on-one with a financial counselor who they can contact any time, even after they buy a home. About 3,000 families have enrolled in the center. About 1,400 of them have bought a home. The center doesn’t have a financial stake if a family decides to buy a home. It just provides the tools and guidance in what’s an overwhelming decision for many.

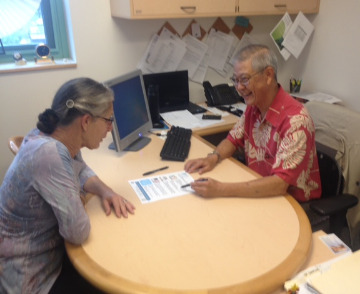

“We give Hawaii families education and direction,” said the center’s executive director Dennis Oshiro. “We’re about empowerment, not entitlement. There are no handouts here.”

Hawaii HomeOwnership Center's executive director, Dennis Oshiro (right), said studies show that a homeowner accumulates 12 times more net worth compared to a renter of equal income. “Homeownership isn’t for everyone,” he said. “But the financial education and coaching that we provide puts families in a better position to make these financial decisions on their own.”

Jessica Rich said the center helps lessen the fear and anxiety during the process of buying her first home. She and her husband have been working with a personal financial counselor at the center to get their finances into shape.

“It’s given us a lot of confidence and peace of mind,” she said. “They’ve taken a lot of stress out of buying a home. It’s good for our emotional and financial well-being.”

They’ve been saving and budgeting for the future. They expect to buy a home by the end of the year.

“It’s a good feeling to have that support system,” she said.